Trust and compliance – introduction

Trust is an essential driver for voluntary compliance.

Tax Administrations have, as part of their mission, opportunities to influence and earn trust in different ways.

Dimensions of trust

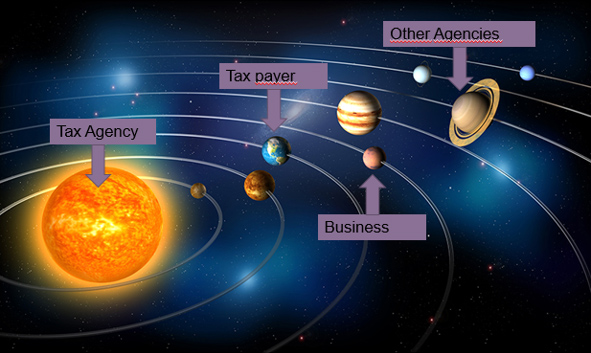

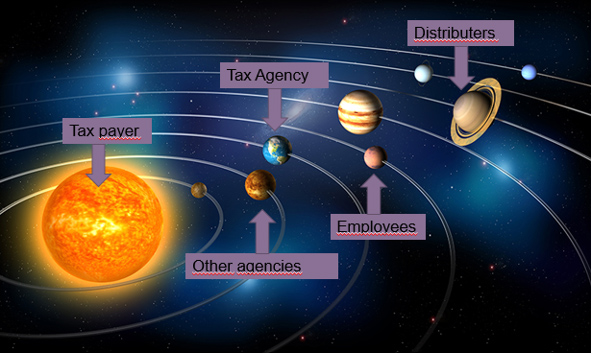

It is essential to understand that taxpayers, Tax Administrations and other stakeholders are all parts of an eco-system. This applies to both a strategic and operational context. In this system there are several dimensions of trust to consider. Taxpayers trust in the public institutions are of particular importance, so is trust between taxpayers i.e. trust that other taxpayers are and will be compliant and trust in other stakeholders. Compliant behaviour is influenced by the taxpayers’ environment where trust is a key factor, possibilities to comply, perceived fairness, social norms etc. are other important factors too.

Source: Skatteverket, The Swedish Tax Agency

The above illustrations show two very different perspectives. If you look at the environment and the stakeholders from the Tax Administration’s viewpoint it looks very different compared to the taxpayer’s perspective. By understanding relations and stakeholders from a taxpayer perspective and a taxpayer point of view, it will be easier for Tax Administrations to find and initiate appropriate ways of cooperation to improve services towards taxpayers which will then impact on voluntary compliance.

The subject of trust and compliance contains a number of different key areas, such as treatment, transparency, cooperation etc. In order to achieve a strategic movement towards a trust based approach it is recommended to approach these areas in a holistic way. They are to a great extent bound together. In this material, these different areas are brought together in nine strategic guidelines.

Taxpayers’ environment and context differs among different countries and cultures. The aim of these guidelines is to support Tax Administrations to make strategic choices.

The activities that are undertaken based on these strategic choices may differ among member states. They should be in accordance with and show consideration for the context and needs of each country.

Voices from EU member countries about Trust and Compliance