An introduction to the content

1 How to use this product

Every Tax Administration in the world is surrounded by its own unique environment, has its own unique system of governance and set of powers to act in the community and towards its employees. The guidelines and examples presented here must, therefore, be seen as such and not as a ‘one size fits all’ set of recommendations. This section aims to help you find your way around this interactive product and to explain how the content is meant to be viewed so you can get the most out of this to assist you strengthen trust and enhance compliance within your Administration.

2 Navigating the interactive product

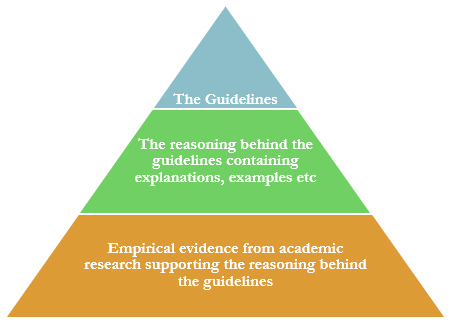

You can access the content of a guideline by clicking on it. The content of each guideline is in turn divided into three levels (see the pyramid illustration below), the first being the combined knowledge of the EU Member States Tax Administrations. If you wish to view practical examples of initiatives taken by the Member States or learn more about the empirical evidence supporting that guideline, press the example icon or the empirical evidence icon.

This pyramid visualises how the different levels of the content are connected:

3 The content and how to view it

3.1 The guidelines

The guidelines are based on the combined experiences of the EU Member States’ Tax Administrations as well as some academic research. This combined knowledge is presented in a way that aims to give top-level-management support on how to strengthen trust.

As every Tax Administration is very different and operates in different economic and cultural environments, the reader should consider the guidelines with this in mind. A Tax Administration looking to increase trust and enhance compliance can find support and advice in the guidelines but this is not a universal ‘blueprint’. The guidelines are a tool to support Tax Administrations and any actions should be adapted to the operating environment.

The guidelines can be read separately as they do not build on each other to reach a final conclusion and they are not presented in ranking order or in importance. The ‘easy-access’ format of the guidelines and the way they are presented is based on the needs and limited time supply of the intended target group which is top level management.

3.2 The examples

There are examples from different Member States attached to each guideline. The country examples have been suggested by the participant countries throughout the course of the project. Some examples where provided by MS outside the Working Group through the Country Profile initiative. These examples will assist you to understand the mechanisms behind how building trust can influence voluntary compliance. These examples are enclosed to serve as inspiration and chosen to represent as wide a range as possible of jurisdictions and legal cultures. They must be read in the context of the specific tax system they emanated from and are not intended to serve as a best practice but rather to spark further work in the field.

3.3 The empirical evidence

Beneath the guidelines and the reasoning behind them lies a base of empirical evidence from academic research. This consists of papers published in leading peer-reviewed journals along with anthology contributions, book-length treatments and working papers from the frontlines of social science research drawing primarily on economics, behavioural economics, psychology, political science and sociology.

As such, this body of work constitutes known empirical facts and findings about the dynamics of trust and compliance at the highest level of knowledge possible. This base of research thus forms a foundation under the structure that is our guidelines and the reasoning behind them. While some of the studies included in this collection deals directly with, for example, various ways for tax administrations to engage with taxpayers in order to enhance compliance, most research on tax compliance deals with human behaviour in tax-related choice situations or similar at a fundamental level.

Thus, rather than explicitly providing lessons for tax administrations that can be implemented directly in compliance strategies etc., the mass of academic studies in tax compliance constitutes a pool of knowledge which, taken together, enables the formulation of guidelines for tax administrations about working with trust-based approaches to enhance compliance.

For a complete text edition of the research, download it here: Compiled research![]()